Learn more about our approach to green bonds and the positive impact we have achieved.

The Green Bond Report is published annually as part of the Q1 publication.

In November 2022, we introduced our Green Bond Framework. As part of this, all outstanding bonds were reclassified as Green Bonds. Future bonds will also be issued as Green Bonds. In spring 2023, all bank loans were also linked to sustainability criteria.

The Green Finance approach emphasises the importance of sustainability as an integral part of our strategy by linking our debt financing with the sustainability strategy and, in particular, our commitment to reduce CO2 emissions

Our basis for green financing

The Green Asset Portfolio is the basis for the Green Bond Framework and the green loans.

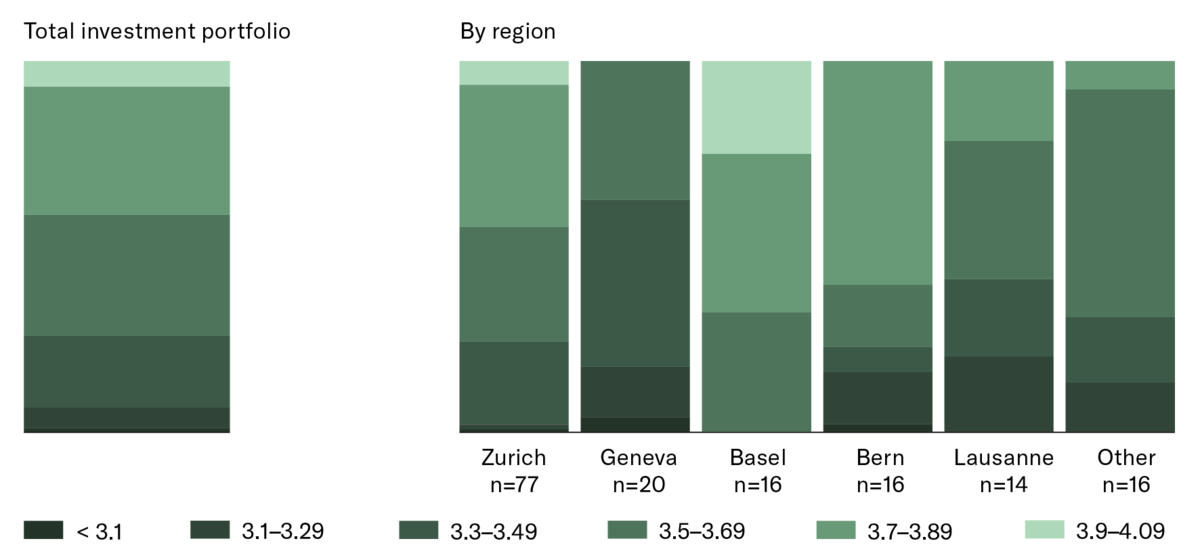

The inclusion of a property is based on two criteria, which must be met simultaneously: the effective CO2 emissions per square meter and a property-specific sustainability rating. The core of this framework is the ongoing improvement of CO2 emissions. The current limit for inclusion of investment properties is 12 kg CO2 per square meter. The sustainability rating is determined by the independent company Wüest Partner. The Green Asset Portfolio is generally revised once a year.

Working tool and qualification criterion

The property-specific Wüest ESG rating pursues a holistic approach that integrates various aspects in the environment, social and governance categories.

Percentage distribution of ESG rating 2022 (by lettable area)

Transparency with regard to approach and performance

Learn more about our approach to green bonds and the positive impact we have achieved.

The Green Bond Report is published annually as part of the Q1 publication.