Optimised real estate portfolio

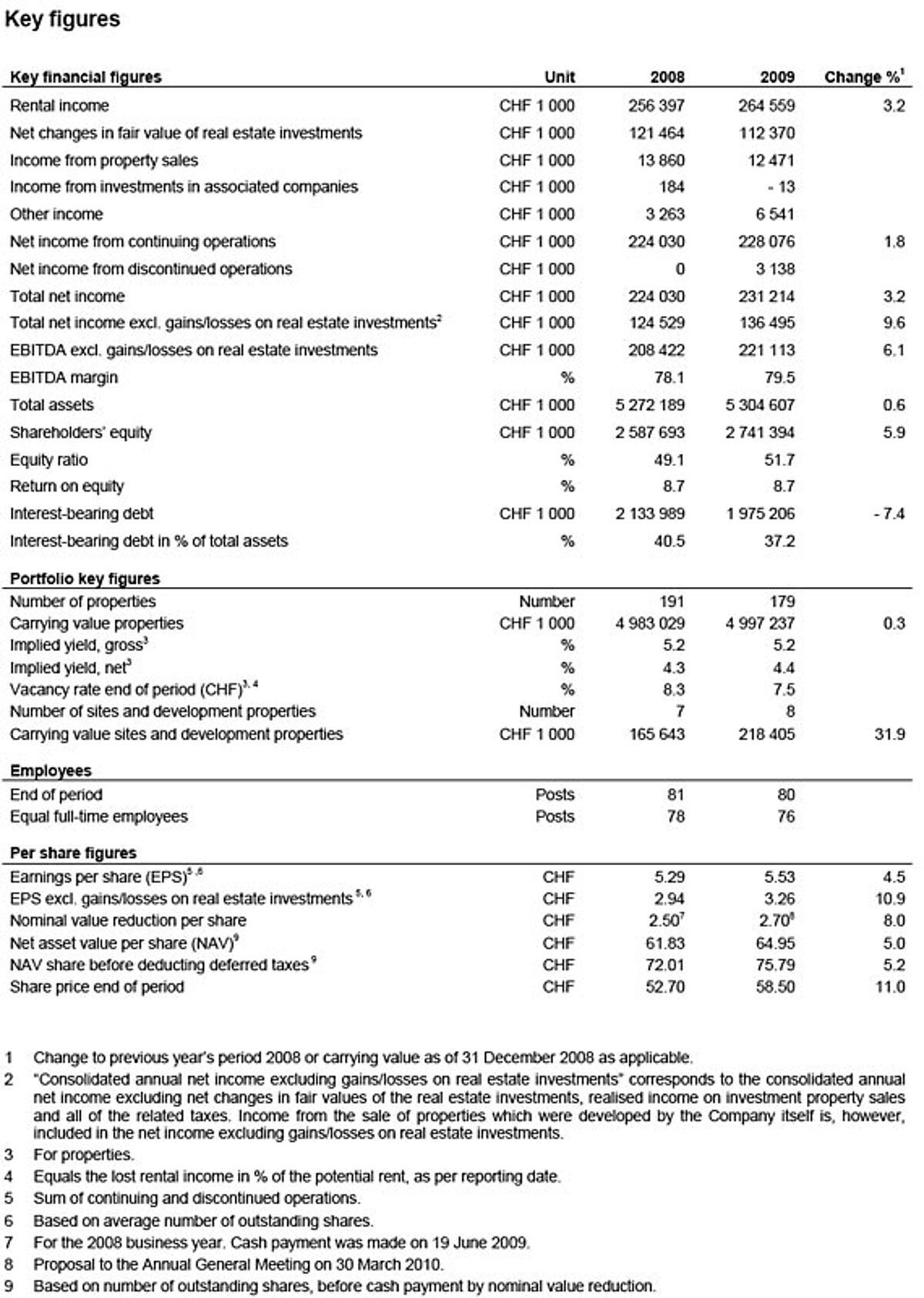

As at the end of 2009, the real estate portfolio included 179 office and commercial properties in prime locations as well as eight attractive development sites with a total carrying value of CHF 5.216 billion (end of 2008: CHF 5.149 billion). A number of acquisition opportunities were evaluated during the year, but no purchases were made. With a view to continuously optimising the portfolio, nine investment properties have been sold. Net sales revenue totalled CHF 140.6 million, 12.4% above the last estimate of Wüest & Partner.

The revaluation of properties resulted in an appreciation of CHF 112.4 million (2008: CHF 121.5 million). This appreciation was mainly the result of the successful vacancy reduction and new leases at higher rents.

Successful vacancy reduction

By year-end 2009, the vacancy rate was 7.5%, a reduction of 0.8% compared to end of 2008. 1.6%-points are related to renovation work on several properties: 0.5%-points refer to Route des Acacias 52 in Carouge which will be fully let after completion of the renovation work (as per 1 July 2010). 0.7%-points refer to the renovation of the property on Aarbergstrasse 94 in Biel, which will be completed in 2010.

Record operating results

Rental income grew by 3.2% to CHF 264.6 million. This increase of CHF 8.2 million was mainly the result of the vacancy reduction in the previous year, higher rents and two special effects which occurred in the first half of 2009 (the release of provisions for contingent losses of CHF 1.3 million which were no longer needed, the partial release of a provision after final negotiations of a previously pending lease contract of CHF 1.1 million). Operating expenses fell by 2.8% to CHF 58.1 million. This decrease was due to slightly lower real estate operating expenses and significant lower general and administrative expenses.

Positive earnings development and an optimised cost structure resulted in an increase of EBITDA excluding gains/losses on real estate investments by 6.1% to CHF 221.1 million (2008: CHF 208.4 million). Consequently, the EBITDA margin rose to 79.5% (2008: 78.1%).

Very solid capital structure

With a loan-to-value of 37.2% (end of 2008: 40.5%), the capital structure remains very solid. Currently, the amount of unused credit lines is CHF 630 million. In 2010, no financing is due and in 2011 only CHF 100 million will mature. In the reporting period, the average interest rate was 2.54% (previous year's period: 2.75%). As at the end of 2009, the average fixed-interest period was 3.0 years (end of 2008: 3.1 years).

Proposal for a higher nominal value reduction

The Board of Directors proposes a cash distribution in form of a nominal value reduction of CHF 2.70 per share (previous year: CHF 2.50 per share) to the Annual General Meeting on 30 March 2010, leading to an increase of 8%. Compared to net income excluding gains/losses on real estate investments (CHF 3.26), this corresponds to a payout ratio of 82.8%; in relation to the 2009 year-end closing price of the PSP-share (CHF 58.50), this corresponds to a payout yield of 4.6%.

Addition to the Board of Directors

The Board of Directors proposes to the Annual General Meeting of 30 March 2010 to elect Mr. Peter Forstmoser as additional member of the Board of Directors for a statutory term of one year. Mr. Forstmoser shall support the Board of Directors in strategic and corporate governance issues.

Outlook 2010

Despite the difficult economic environment, PSP Swiss Property is confident about the medium- and long-term future thanks to its well-established market position, its strong capital base and its high quality property portfolio. In the current year, the evaluation of acquisition opportunities as well as the management of vacancies will be at the top of the agenda. In order to enhance the attractiveness of the investment properties, higher capital expenditures are planned for 2010.

The rental income for 2010 will be negatively impacted by the foregone rental income of the 2009 property sales and the non-repeat of the special effects of the first half-year 2009. In consideration also of the above mentioned increased capital expenditures, we expect an EBIDTA excluding gains/losses on real estate investments exceeding CHF 210 million.

With regard to vacancies, we expect a rate of approx. 8% at the end of 2010. The finalisation of the Businesspark Richtistrasse in Wallisellen, expected by mid-year 2010, might contribute additional 1.5%-points of vacancy.