Real estate portfolio

At the end of March 2011, the real estate portfolio included 173 office and commercial properties in top locations. In addition, there were seven sites with attractive development projects. The carrying value of the total portfolio stood at CHF 5.532 billion (end of 2010: CHF 5.518 billion). During the first quarter of 2011, no acquisitions were made; two small, nonstrategic properties in Thun and Zurich were sold.

The ongoing site developments progressed as planned.

Vacancy rate

At the end of March 2011, the vacancy rate stood at 8.8% (end of 2010: 8.5%). 1.3 percentage points of the 8.8% were due to ongoing renovation work on various properties. The properties in Zurich West and Wallisellen (carrying value CHF 0.8 billion) contributed 4.8 percentage points to the overall vacancy rate; these sub-portfolios excluded, the investment portfolio with a carrying value of CHF 4.4 billion contributed only 2.7 percentage points.

Of the lease contracts maturing in 2011 (CHF 39.0 million), 74% had already been renewed respectively extended at slightly better conditions at the end of March 2011.

Quarterly results Q1 2011

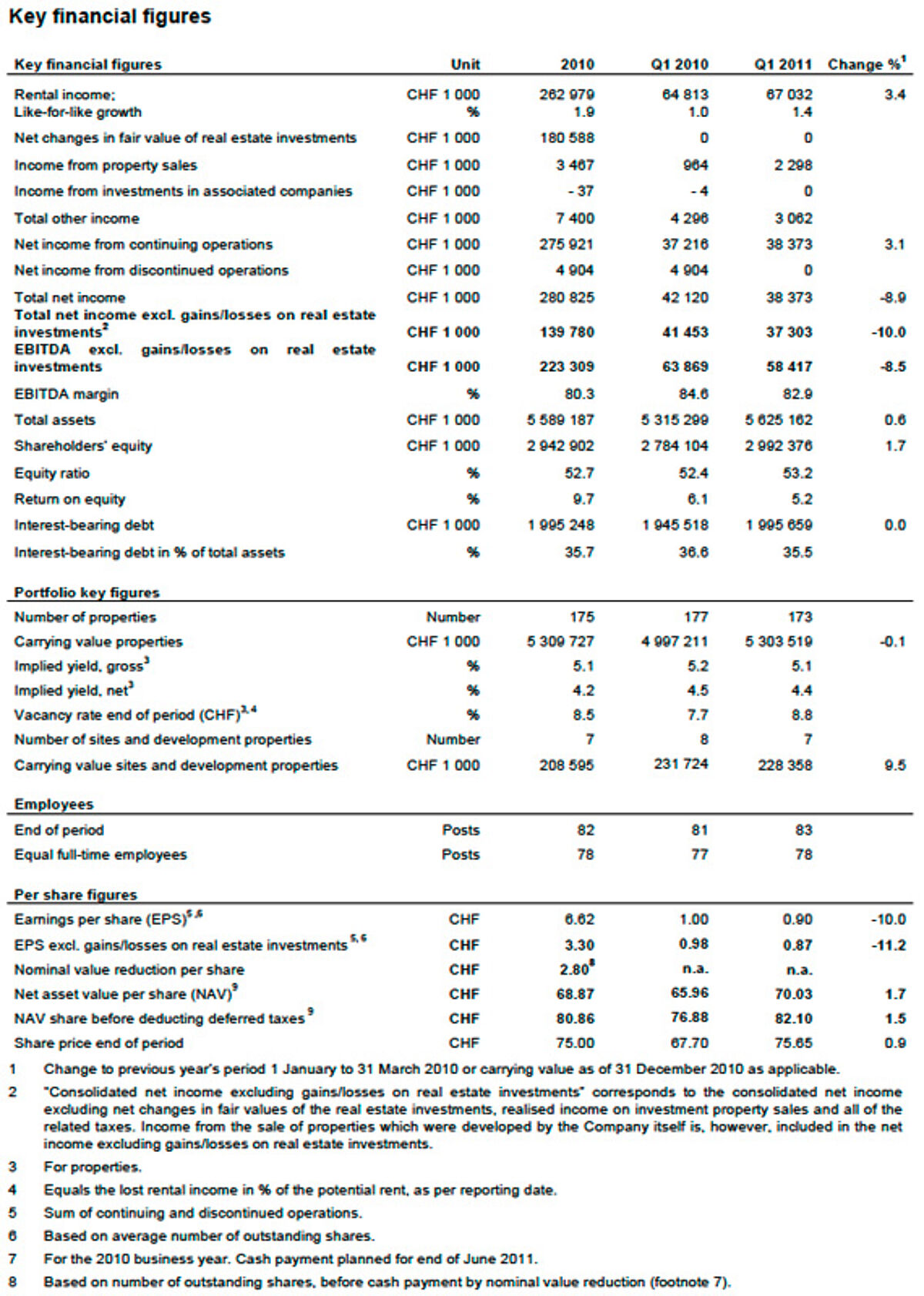

Net income excluding changes in fair value decreased from CHF 41.5 million to CHF 37.3 million. Corresponding earnings per share amounted to CHF 0.87 (Q1 2010: CHF 0.98). The decrease was due to the termination of income from discontinued operations (CHF 4.9 million in 2010), i.e. to the last earn-out payment in 2010 from the sale of the third party property management business.

Rental income increased by CHF 2.2 million to CHF 67.0 million. This rise resulted from: i) rental income generated by the property Seestrasse 353 in Zürich which was acquired in April 2010, ii) rental income generated by the thermal bath (on the Hürlimann site in Zurich) which was completed in December 2010 and iii) increased rental income as a result of successful new leases, mainly on renovated properties.

With CHF 12.2 million, operating expenses remained relatively stable (Q1 2010: CHF 11.8 million); only real estate maintenance and renovation expenses rose by 21.0% to CHF 3.9 million (Q1 2010: CHF 3.3 million).

Financial expenses increased slightly to CHF 11.8 million (Q1 2010: CHF 11.2 million).

At the end of March 2011, net asset value (NAV) per share was CHF 70.03 (end of 2010: CHF 68.87). NAV per share before deferred taxes amounted to CHF 82.10 (end of 2010:CHF 80.86).

Solid capital structure, low interest expenses

With a loan-to-value of 35.5% (end of 2010: 35.7%), the capital structure remains very solid. The amount of unused credit lines is CHF 730 million. No bank loans will be due until 2013; a CHF 250 million bond and a CHF 40 million private placement will mature in 2012. In the reporting period, the average interest rate was 2.62% (Q1 2010: 2.55% resp. 2.58% for the whole 2010 business year). At the end of March 2011, the average interest rate stood at 2.61% (end of 2010: 2.61%) and the average fixed-interest period was 3.0 years (end of 2010: 3.2 years).

Outlook 2011

PSP Swiss Property remains confident for the 2011 earnings development. The outlook is unchanged from the one communicated at the end of February 2011.

Concerning vacancies, the main goal will be the stabilisation of the vacancy rate. A rate of approximately 9% is expected at the end of 2011.

With regard to the sites, the focus will be on two sites in Zurich, the Hürlimann site (completion of the hotel) and the Löwenbräu site (under construction). The other sites are interesting longterm projects which are partly still in the planning phase.

Based on the assumption of an unchanged property portfolio, an EBITDA excluding gains/losses on real estate investments of approximately CHF 220 million is expected for 2011 (2010: CHF 223.3 million). There are three reasons for the slightly lower EBITDA: i) discontinuance of income from discontinued operations, ii) higher costs for renovations at a number of properties to enhance their attractiveness and iii) lower tax refunds from submitting certain rental contracts to the value added tax (opting in).